CSIO 2022 Annual Report

Innovation is motion.

2022 Highlights

CSIO’s members don’t just share our commitment to innovation. They help drive it.

Together, we’ve had

another successful year supporting customer experience improvements by developing and maintaining our

Standards, tools and services.

We took a number of important steps forward in 2022. Each reinforces our advancement of reliable, secure technology solutions. Each empowers our insurer and vendor members to innovate on behalf of their broker partners and customers.

Who We Are

Our Members

85+

Insurers

45+

Vendors

38k+

Brokers

An ever-growing network of digitally-

focused industry leaders.

Board of Directors

The Board of Directors provides insight and leadership that enables CSIO to continuously drive the Canadian P&C industry forward. We greatly appreciate the efforts of these knowledgeable executives for another successful year.

Mathieu Brunet

Vice President,

Insurance Operations,

MP2B Assurance

Joseph Carnevale

Vice President, Sales - Greater Toronto and Hamilton Area (GTHA),

A.J. Gallagher

Steve Earle

President,

Bauld Insurance

Christopher Harness

Chief Information Officer,

Northbridge Financial Corporation

Aly Kanji

President &

Chief Executive Officer,

InsureLine Brokers Inc.

Tatjana Lalkovic

Senior Vice President and Chief Technology Officer,

Definity Financial

Michael Lin

Chief Information Officer,

Travelers Canada

Cam Loeppky

CSIO Chairman,

Senior Vice President &

Chief Information Officer,

The Wawanesa Mutual

Insurance Company

Catherine Smola

President &

Chief Executive Officer,

CSIO

Luc Tanguay

Senior Vice President -

Commercial Lines,

Intact Financial Corporation

Zoey Todorovic

Chief Information Officer,

Aviva Canada

James Warburton

Chief Information Officer,

Gore Mutual Insurance Company

Sheldon Wasylenko

CSIO Vice Chair,

General Manager,

Rayner Agencies Ltd.

Peter Braid

CSIO Guest Member,

Chief Executive Officer,

Insurance Brokers Association of Canada

Championing

Broker Technology

All of our members share a common goal – to deliver the best possible customer experience. CSIO champions secure technology Standards, tools and services to drive customer satisfaction across the insurance value chain. Our efforts ensure that insurer and broker systems work together, exchanging data in a structured format, efficiently and accurately.

CSIO’s Innovation and Emerging Technology (INNOTECH) Advisory Committee and its Working Groups are committed to advancing broker technology. Working together with our members, we delivered a number of firsts in 2022, addressing the industry’s most common pain points related to Application Programming Interface (API) Data Standards, API Security Standards and Billing & Claims eDocs Notifications.

INNOTECH API Data Standards

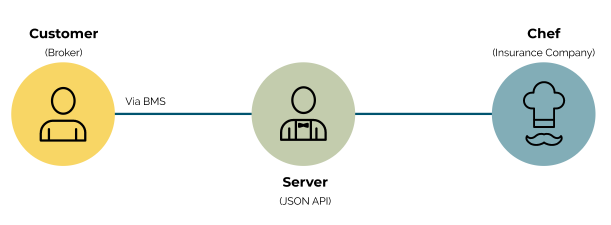

Broker management systems (BMS) and the insurer systems they need to communicate with don’t always speak the same language. As a result, brokers need to access an insurance company’s portal or contact the insurer – via email or telephone – to access customer information.

APIs enable BMS and insurer systems to share information with one another. Insurer systems programmed with API coding can do so securely, in real-time – faster than ever before. JavaScript Object Notation (JSON) is the best-available technology for API data interchange, delivering larger amounts of information between insurer and broker systems, more quickly than before.

Think of the broker as a restaurant customer. The insurance company – the chef in this metaphor – prepares whatever meal the broker asks for. The order is submitted via BMS, and relayed to the kitchen by JSON API Standards. That makes JSON the restaurant server. JSON ensures that the broker’s request is communicated quickly, clearly and efficiently. Far more so than if the broker were to go into the kitchen and try to get the chef’s attention directly.

A Big Year for CSIO’s API Data Standards

CSIO’s INNOTECH Advisory Committee and API Working Groups delivered on our 2022 API

Development Roadmap.

January

The Insurance Brokers Association of Canada (IBAC) Data Exchange (DX) initiative rolled into the INNOTECH API Roadmap.

February

Confirmed priority API use cases to be developed for the 2022 roadmap.

March

JSON API Standards published for Individually Rated Commercial Automobile (IRCA) and Commercial General Liability (CGL) policy inquiry.

June

Creating a quote’s business requirements finalized – the year’s first major milestone since IBAC DX rolled into INNOTECH roadmap.

December

Finalized business requirements needed to publish JSON API Standards for 10 new use cases.

2022 API Development Roadmap

There are 40 use cases in total, 10 each for the personal automobile, habitational insurance, IRCA and CGL lines of business.

- Get quote

- Create quote submission

- Request bind

- Policy amendment of details

- Addition of coverage/risk

- Deletion of coverage/risk

- Policy cancellation

- Create first notice of loss

- Get claims status

- Amend payment details

Top Five Benefits of API Data Standards

Real-time data exchange between insurer systems and BMS

Fluid information delivery

Eliminates multiple portals and processes

Improves customer experience

Saves time

INNOTECH API Security Standard

Brokers trying to log into insurer systems have to deal with a variety of authentication and authorization processes. Similarly, BMSs have varying levels of security.

The INNOTECH Advisory Committee and API Security Working Group made progress in the development of one common authentication and authorization API model, by publishing the industry’s first API Security Standard, and set of best practices. This provides brokers the security requirement they need prior to authenticating into an insurer system.

The Working Group has plans to advance the Standard to accommodate more API interaction, and to evolve the API Security Standard for microservices.

Top Three Benefits of the API Security Standard

Seamless log-in process for brokers

Versatility - new functionality will follow

Enables continuous improvement - we’ll keep innovating for future security needs

INNOTECH API Security Accomplishment

API Security Working Group published the P&C Insurance industry’s first API Security Standard

Kim Opheim

Broker Technology and Innovation Consultant at IBAC and INNOTECH Advisory Committee Member

This is foundational work that will support data exchange

Our industry has increasingly leveraged technology to digitize operations since early 2020, which makes security more important than ever. It’s been a great experience working with the CSIO INNOTECH Working Group’s insurers and vendors on this very complex and important API security project. This is foundational work that will support data exchange for the betterment of the broker distribution channel.

INNOTECH API Working Groups: The People Behind the Success

Please join us in thanking the brokers, insurers and vendors who make up our three Working Groups:

API Business Requirements

API Technical Standards

API Security

INNOTECH Billing and Claims

eDocs Notifications

Brokers spend a lot of time chasing billing and claims information. According to a CSIO broker survey:

68%

68% of brokers spend 1 hour plus per day answering customer billing questions.

66%

66% of brokers make at least 1 claims call to an insurer each day.

Billing and Claims eDocs Notifications provide brokers automatic customer billing-and claims-related status updates, directly to their BMS. Insurers can deliver these details securely and easily.

Billing and Claims eDocs Notifications leverage CSIO eDocs and CSIOnet to streamline the flow of information across dozens of use cases. The INNOTECH Advisory Committee and its Working Groups will continue to grow that list in the months and years ahead.

Billing Use Cases

- Payment Schedule on Recurring Payments

- Payment Schedule on Payment Installments

- Payment Returned on Recurring Monthly Payments (no intent to cancel)

- Payment Returned on Payment Installments

- Past Due Payment/Reminder Notice

- Notice of Intent to Cancel/Final Reminder

- Notice of Cancellation Option to Reinstate (registered letter)

- Notice of Cancellation No Option to Reinstate (registered letter)

- Refund Being Returned to Policyholder

- Payment Received/Rescind Cancellation

- Outstanding Balance

- Collection Notice

Claims Use Cases

- Claim Opening

- Claim Reopening

- Claim Close

- Adjuster Assigned

- Adjuster Re-Assigned

- Status Update - Car Rental Update

- Status Update - Total Loss Indicator

- Status Update - Fault Determination/Liability

- Payment Status to Insured (Issued, Date, Location, Payment Method)

Top Five Benefits of Billing and Claims eDocs Notifications

Seamless billing and claims data exchange

Instant access to customer data

Saves broker’s time that can be spent with the customer

Eliminates hard-copy document costs

Better for the environment

Billing and Claims eDocs Certification Program

Our Certification program ensures that insurers’ and vendors’ use of this valuable service meets CSIO Standards.

Congratulations to The Wawanesa Mutual Insurance Company – the first insurer to earn CSIO’s Claims eDocs Certification. Additional insurers and vendors will be certified in 2023.

Lisa Colwell

VP Personal Lines at Wilson Insurance Ltd.

This will enable greater productivity for our brokers

Our brokerage is very excited for Billing & Claims eDocs solutions to be implemented with our carriers. We look forward to the digital solutions reducing operational costs and providing more efficient workflows. This will enable greater productivity for our brokers so they spend less time retrieving information and more time focusing on our clients.

Professional Development

CSIO’s Professional Development offers free, accredited courses (on-demand) and webinars for members to keep pace with the latest trends and best practices.

In 2022, we continued expanding Professional Development by adding new courses and webinars as part of our commitment to helping members improve their knowledge of digital transformation best practices, digital tools and technologies that drive improved, more innovative customer experiences.

Build Your Brand With CSIO’s Digital Member Designation

Looking to stand out as a lifelong learner? Members who complete six courses earn our Digital Member designation.

Top Five Benefits of Professional Development

Free, accredited courses on demand

Industry-recognized Digital Member designation

Top professional instructors

Increase brokers’ digital competencies

Promotes digital best practices

Jennifer Berfelz

Personal Lines Account Executive, General Insurance Division at Programmed Insurance Brokers Inc.

The on-demand courses make it convenient to learn on your own time

The variety of accredited topics CSIO’s education program covers makes it easy to find a course that is relevant to what you want to learn in today’s ever-changing digital world. The on-demand courses make it convenient to learn on your own time and fit into your schedule. You’ll have the six credits you need to earn the Digital Member designation in no time.

Industry Standards Drive

Customer Experience

For more than four decades, CSIO has developed Data Standards and tools for the Canadian Property & Casualty (P&C) Insurance industry.

By helping to streamline the transmission of insurance information, CSIO Data Standards and tools empower our insurer and vendor members to innovate on behalf of their broker partners and the customers they work hard to serve.

We share our members’ dedication to continuous improvement. CSIO supports brokers across the industry, with Commercial Lines (CL) Data Standards and CSIO Data Standards.

Commercial Lines Data Standards

Our CL Working Group made significant progress supporting real-time small business commercial quote and bind this year.

Real estate was added to the list of small business commercial segments sharing a common data set and streamlined data exchange. The real estate segment joins the contractor, retailer and business and professional services segments, as well as multi-operations small business. Brokers can now provide these customers dynamic, real-time pricing that accommodates limit and risk changes. These Standards mean small business commercial quotes can be produced accurately in minutes, saving brokers time and money, and improving the customer experience. Additional segments will follow in the years ahead.

Top Five Benefits of CL Data Standards

Automated quotes in real time

Faster information flow between broker and insurer systems

More accurate quotes

Savings by the digitalization of transaction

Automatic generation of electronic policy documents by a broker management system

The Working Group also finalized the requirements to bind small commercial business. This enables the exchange of information between broker and insurer systems during the binding process in real time.

The Working Group also developed the Commercial Lines Real-Time Quote Savings Calculator. Brokers can use it to assess the savings available to them when they work with insurers and broker management system vendors who have implemented CSIO’s Commercial Lines Minimum Data Set.

We are grateful to the members of our Commercial Lines Working Group. Their dedication makes a positive impact on our industry every day.

Silvy Wright

President & CEO at Northbridge Financial

This innovation is an important first step in collaborating

Insurance companies that have adopted CSIO Commercial Lines Data Standards are now launching initiatives that allow brokers to efficiently exchange small business submission and quote data right from their own broker management systems. This innovation is an important first step in collaborating with brokers and other carriers to evolve and modernize, creating value for brokers, carriers – and ultimately, our customers.

Commercial Lines Certification Program

Organizations that choose to demonstrate their commitment to CL Data Standards have our full support. The CL Certification program is CSIO’s guarantee that an insurer or vendor is fully compliant with industry best practices.

Applied Systems, Northbridge Insurance and The Wawanesa Mutual Insurance Company each achieved Level 3 certification in 2022.

CSIO Data Standards

We never stop updating the CSIO Data Standards. As industry requirements evolve, so do the Standards that keep the industry’s ecosystems communicating effectively. Our National Standards Working Group reviews and implements updates monthly.

Policy documents, eDocs, eSlips, and EDI and XML downloads all go through CSIOnet, and all rely on standardized communication. Keeping these living documents in sync with business needs is an essential service that we’re proud to deliver.

3 sets of CSIO Data Standards: EDI, XML and JSON

20+ organizations working together to ensure the Data Standards evolve with industry requirements

152 updates to the CSIO Data Standards

Please join us in recognizing the members of our National Standards Working Group. They continue to do important work for Canada’s P&C Insurance industry.

Services and Solutions

You Can Trust

CSIO remains dedicated to developing and maintaining reliable, secure services for the Canadian P&C Insurance industry. We completed improvements to two of our popular services in 2022: My Proof of Insurance (MPOI) and CSIOnet.

CSIO expanded the MPOI eDelivery platform and implemented new features, some as a direct result of member feedback. We also moved CSIOnet to a robust, cloud-based platform provided by Amazon Web Services (AWS). This is a major step forward for CSIO and the industry. We have repeatedly demonstrated our commitment to improving customer experience in the broker channel – another significant achievement that will accommodate continued innovation and growth in the years to come.

My Proof of Insurance

MPOI is Canada’s leading solution for the secure, electronic delivery of personal and commercial policy documents (eDocs), including proof of auto insurance (eSlips). Policyholders can receive and view documents on any device, and eSlips can be stored in a smartphone’s mobile wallet.

The COVID-19 pandemic accelerated the digitization of Canada’s P&C Insurance industry, out of both necessity and rising consumer demand. Thanks to the foresight of CSIO leadership, the MPOI delivery platform was already established as a seamless and secure electronic document delivery platform well before 2020.

In fact, the MPOI platform has been improving steadily since its launch in 2018. And, in that time, Canadians have received over a million and a half documents (including eSlips) through the platform.

Top Six Benefits of My Proof of Insurance

Fast and seamless

Bank-grade security

Compliant with

industry regulations

Plug-and-play

implementation, with

minimal training required

Sends policy

documents, billing

statements and eSlips

Works on any device,

with no need for

apps or passwords

Expanding MPOI’s Capabilities

In 2022, we took three big steps forward with MPOI:

- Updated the technology that supports MPOI, to maintain its bank-grade security and high-speed functionality

- Enhanced security measures and protocol

- Added new capabilities, such as adding functionality to send eSlips for garage policies

Cam Loeppky

Senior Vice President & Chief Information Officer at

The

Wawanesa Mutual Insurance Company and CSIO Board Member

Whatever we need to send to customers, we can do it using this solution

My Proof of Insurance met all of the requirements for our paperless strategy. It’s a multifunctional solution capable of sending not only eSlips, but any renewal document, new policy, endorsements, and even billing and claims statements. Whatever we need to send to customers, we can do it using this solution.

eDocs

Thanks to CSIO’s eDocs solution, brokers can download policy documents into their BMS, directly from an insurer’s system via CSIOnet. These eDocs are fully standardized. Insurers who use them structure their data within agreed-upon rules so that the data can be read and stored by any software.

In 2020, we launched Billing and Claims eDocs notification solutions, and added Billing and Claims to the CSIO eDocs Certification Program. eDocs reduce paper usage, deliver more efficient workflows and facilitate real-time, instantaneous transactions. We recognize all of our members who have made the commitment to eDocs through Certification.

Top Five Benefits of eDocs

Supports all lines of business – personal, commercial, farm – and billing and claims documents

Works with any software, document and file type

Ensures seamless transfers and easy downloads

Established as the industry’s most widely-used document delivery technology

Designed for CSIOnet, the industry’s leading platform

46 million+ eDocs sent in 2022

38,000+ brokers and 85+ insurers access CSIOnet daily

CSIOnet

CSIOnet is an established, widely adopted platform on which data and documents are exchanged between insurers and brokers in the Canadian P&C Insurance industry. The platform sends eDocs and uses EDI and XML to allow brokers to automatically download policy information.

Greater Capacity, Reliability and Performance

We modernized CSIOnet in 2022 by moving it from a legacy physical server platform to a robust, state-of-the-art Amazon Web Services (AWS) cloud-based environment.

This expands the platform’s capacity, delivers enhanced reliability for optimal performance, improves download speeds and upgrades security measures to better protect information shared across the system.

Upgrading CSIOnet meets the evolving expectations of policyholders, along with the security and stability requirements of the companies that serve them.

The transition was an industry-wide initiative that involved insurers, vendors and broker members. It is a remarkable example of collaborative problem-solving and robust testing – work that involved the CSIOnet User Acceptance Testing Steering Committee and the User Acceptance Testing Group. Members of both groups deserve our thanks for their dedicated support.

Top Six Benefits of CSIOnet’s AWS Cloud Platform

Maintained a consistent user experience for brokers, insurers and vendors

Faster electronic data interchange and eDoc transfers

Improved problem detection and resolution

Enhanced security to reduce cybersecurity and other risks

Scalable capacity to support continued innovation

Streamlined innovation capabilities to meet evolving customer demands

The Power of a Modernized CSIOnet

AWS Cloud-Based Environment |

Legacy Platform |

|

|---|---|---|

|

Delivery - Insurer to BMS |

3-5 minutes (based on BMS polling frequency set) |

1 to 2 days (based on backlog volume) |

|

Average response time per transaction |

0.06 seconds, with occasional peaks of 17 seconds |

0.5 seconds, with regular peaks of 10 minutes (causing timeout issues) |

|

Capacity |

3-x volume capacity |

Unable to meet daily capacity, with frequent backlogs |

|

Stability |

System capacity can accommodate future growth |

Systems regularly at 85% to 100% capacity, causing outages during |

Source: Cloudwatch and Kowshik

CSIOnet Accomplishment

Migration of CSIOnet to an Amazon Web

Services cloud-based

environment