CSIO 2023 Annual Report

Onward

as one

2023 Highlights

We began executing our new multi-year strategic plan in 2023. CSIO’s Board of Directors identified three areas of focus in the plan: Standards, industry-trusted technology solutions, and solutions and services for creating a seamless experience.

In 2023, CSIO gained momentum by progressing in all three areas. We continued advancing our Standards to ensure they are clear. We delivered secure and reliable technology solutions and shaped solutions to provide seamless data exchanges. We also further expanded our respected education services.

Working in close collaboration, CSIO and its members continued to drive innovative solutions that enable the best insurance experience in Canada. We are proud of our 2023 accomplishments. Each one benefits our members and the customers they’re proud to serve.

Message from

the President & CEO

Catherine Smola

CSIO President & CEO

Thanks to our members, Board of Directors and staff, we have much to celebrate. The momentum we gained in 2023 greatly contributed to our successes. In reflecting on our achievements, they share a common theme – onward as one.

In 2023, we began executing CSIO’s next multi-year strategic plan, which involves three areas: developing, governing, and promoting Standards; delivering industry-trusted technology solutions; and shaping solutions and services for creating a seamless experience. Thanks to our members, Board of Directors and staff, we have much to celebrate. The momentum we gained in 2023 greatly contributed to our successes.

I’m proud of CSIO’s accomplishments in continuing to drive innovation through Data Standards and technology to benefit our members and their customers. In reflecting on our achievements, they share a common theme – onward as one. Here’s how we came together to streamline property and casualty insurance operations this year.

The refinement of eDocs codes and descriptions was an important component of producing unambiguous Data Standards. Brokers voiced their concern that the inconsistent labeling of eDocs, by their insurer partners, was costing them valuable time and resources. To address this broker pain point, our eDocs Working Group came together and reached a consensus on a list of updated eDocs codes and descriptions. Through industry collaboration, we achieved our goal of developing clearly labelled eDocs that will save brokers time and money. An eDocs Programming Scorecard was published to show implementation start dates provided by insurers and broker management system (BMS) vendors for programming the refined eDocs codes and descriptions in their systems. CSIO also established an eDocs Implementation Steering Committee to ensure the successful industry implementation of the updated eDocs codes and descriptions.

The Standards Governance Advisory Council was formed to ensure a consistent interpretation of Data Standards by insurers and BMS vendors. Comprised of CSIO members, the Council developed a Standards Certification Rating System, that they will oversee so that high-quality, relevant Standards respond to current and future needs.

Commercial Lines (CL) Data Standards were further advanced thanks to our CL Working Group. We published CL Data Standards for quoting and binding the hospitality, health services and warehousing industry sectors, bringing the total number of sectors to seven. Furthermore, L’Unique General Insurance earned their Level 3 CL Certification, showing their commitment to implementing CSIO CL Data Standards to create greater value for broker partners and customers. Congratulations to L’Unique on this achievement.

The Application Programming Interface (API) Security Standards Certification program was launched thanks to the work done by the Innovation and Emerging Technology (INNOTECH) Advisory Committee and its API Security Working Group. This Certification confirms that an insurer or BMS vendor is aligned with CSIO’s API Security Standards and has mitigated security concerns for API endpoints. I congratulate Northbridge Insurance on being the first insurer member to attain our API Security Standards Certification.

CSIOnet and My Proof of Insurance (MPOI) provide reliable and secure digital experiences for our members and their customers. CSIOnet met availability and performance criteria after being upgraded to the robust Amazon Web Services (AWS) cloud-based environment in 2022. This year, there was more than a 10% increase in the volume of messages sent and a record number of over 48 million policy documents sent via CSIOnet. MPOI also met availability and performance criteria, and we continued making enhancements to MPOI’s functionality and security so that members can send electronic documents to their customers quickly and seamlessly. Since its 2018 launch, members have sent more than 2.5 million digital documents, including eSlips, through MPOI.

JavaScript Object Notation (JSON) API Data Standards were further developed by the INNOTECH Advisory Committee and its API Implementation Working Groups by completing the business requirements for an additional 165 use cases. A JSON API Implementation Guide was released, and along with the API Security Standards and JSON API Standards for technical schemas that CSIO published, insurers and BMS vendors have access to the primary tools and APIs necessary for the majority of the brokers’ daily business activities.

Professional Development was expanded to enhance our members’ learning experience. In response to member feedback, we introduced a fourth stream covering Industry Trends & Initiatives, launched a Building a Culture of Ethics in Insurance webinar and course, and added new technology trends courses, such as Generative AI and Marketing Automation. Lastly, to help our members learn more about important industry topics and initiatives, we published an online Resource Centre.

CSIO ended 2023 on a high note thanks to the creativity and collaboration of our members, Committees, Working Groups, Board of Directors and employees. By continuing to deliver industry-leading technology solutions, robust Data Standards and a highly-regarded educational program, we continue to drive digital transformation for the P&C industry. We remain committed to moving our strategic plan forward and setting our members up for success in 2024.

Sincerely,

Catherine Smola

CSIO President & CEO

Message from

the Chairman of the Board

Michael Lin

CSIO Chairman

Chief Information Officer

Travelers Canada

I am proud of what CSIO has accomplished for the betterment of the Property and Casualty (P&C) insurance industry. Our broker, insurer and vendor members collaborated to enhance Data Standards, solutions and services that benefit our members.

I look back at 2023, my first year as CSIO’s Chairman of the Board, with optimism as we introduced our new multi-year strategic plan. The plan serves as an important vehicle to keep us on the same page moving forward. Our broker, insurer and vendor members collaborated to enhance Data Standards, solutions and services that benefit our members. I am proud of what CSIO has accomplished for the betterment of the Property and Casualty (P&C) insurance industry.

CSIO’s strategic plan included further improving our Standards development and their corresponding implementation guides to ensure there is no room for different interpretations. Our most important achievement was updating the eDocs codes and descriptions thanks to the concerted efforts of the eDocs Working Group. This initiative builds industry confidence that everyone is speaking the same language, and brokers will no doubt value receiving clearly labelled eDocs from their insurer partners.

CSIO will not only continue to create and publish the Data Standards as part of the strategic plan, but will now also govern these Standards. To bring this to fruition, we formed a Standards Governance Advisory Council, which established a Standards Certification Rating System, which will include an annual review process to help ensure members' ongoing compliance with CSIO’s Data Standards. There will be more to share on the Certification Rating System in 2024.

Our Commercial Lines (CL) Working Group continued making progress by developing CL Data Standards for three additional industry segments. When programmed by insurers and vendors, these Standards give brokers the ability to quote directly in their broker management system (BMS). On the Certification front, we now have six members who are Level 3 CL Standards Certified and have demonstrated their commitment to real-time CL quoting.

The Innovation and Emerging Technology (INNOTECH) Advisory Committee, and its Application Programming Interface (API) Implementation Working Groups, delivered CSIO’s 2023 API Roadmap by publishing JavaScript Object Notation (JSON) API Standards for personal and commercial insurance use cases. These Standards address the need for real-time data exchange between BMSs and insurers’ systems. Building on the work done in 2022 by the API Security Working Group in developing a standard authentication and authorization model for insurers and BMS vendors, we introduced an API Security Certification program. I am pleased to say that we had our first member, Northbridge Insurance, become Certified in 2023, with more planned for 2024.

Finally, we continued providing reliable and credible technology solutions to our members with CSIOnet and My Proof of Insurance (MPOI). After upgrading CSIOnet to an Amazon Web Services (AWS) cloud platform in 2022, we were able to meet the availability criteria and handle an increase in the volume of eDocs and messages in 2023. I am happy to report that CSIO achieved a 99.84% availability rate for both CSIOnet and MPOI (excluding scheduled maintenance) – surpassing our target for the year. Our continuous enhancements to MPOI’s functionality and security since its launch in 2018 ensure that MPOI remains a robust and seamless solution for emailing customers digital policy documents and proof of auto insurance (eSlips).

I’m thrilled to share that CSIO successfully completed the first year of its multi-year strategic plan and continues to drive positive change in the P&C industry. We built a solid foundation for the remaining years of our plan, and in 2024 we’ll focus on further enhancing the initiatives developed this year.

It has been a privilege to work closely with my amazing colleagues on the Board of Directors, and I would like to thank them for their support during my first year as Chairman.

I look forward to another promising year.

Sincerely,

Michael Lin, CSIO Chairman

Chief Information Officer

Travelers Canada

Who We Are

Our Members

85+

Insurers

45+

Vendors

38k+

Brokers

Working together to move the industry forward

Board of Directors

The Board of Directors’ guidance and expertise help CSIO drive innovation for the P&C industry. We thank these committed executives for their contributions to another successful year.

Mathieu Brunet

Vice President -

Insurance Operations,

MP2B Assurance

Steve Earle

President,

Bauld Insurance

Christopher Harness

Chief Information Officer,

Northbridge Financial Corporation

Aly Kanji

President and

Chief Executive Officer,

InsureLine Brokers Inc.

Tatjana Lalkovic

Senior Vice President and Chief Technology Officer,

Definity Financial

Michael Lin

CSIO Chairman,

Chief Information Officer,

Travelers Canada

Michael Loeters

Senior Vice President -

Commercial Insurance,

PROLINK

Cam Muckosky

Vice President -

Digital Delivery,

The Wawanesa Mutual Insurance Company

Aaron Newell

Vice President -

Governance & Analytics,

Aviva Canada

Catherine Smola

President &

Chief Executive Officer,

CSIO

Luc Tanguay

Senior Vice President -

Commercial Lines,

Intact Financial Corporation

James Warburton

Chief Information Officer,

Gore Mutual Insurance Company

Sheldon Wasylenko

CSIO Vice Chair,

General Manager,

Rayner Agencies Ltd.

Peter Braid

CSIO Guest Member,

Chief Executive Officer,

Insurance Brokers Association of Canada

Advancing

CSIO Data Standards

For over four decades, brokers, insurers and vendors across Canada’s Property and Casualty (P&C) insurance industry have relied on CSIO Data Standards to ensure the efficient sharing of information. By helping to streamline the transmission of insurance information, CSIO Data Standards enhance P&C insurance operations for the benefit of members and their customers.

In developing CSIO’s 2023 to 2025 strategic plan, CSIO’s Board of Directors identified an opportunity to further improve Standards development and corresponding implementation guides to ensure there is no room for differing interpretations.

CSIO is focused on:

Standards development:

Producing clear, comprehensive Standards that are not open to interpretation.

Standards governance:

Implementing a Standards adoption framework that includes a detailed classification rating and forming a Standards Governance Advisory Council.

Standards promotion:

Communicating and promoting the benefits of CSIO’s comprehensive, clearly defined Standards.

There was much to celebrate in 2023. Thanks to dedicated CSIO members, working with CSIO staff, we advanced Data Standards with three major accomplishments.

Refinement of eDocs Codes and Descriptions

Broker efficiency has been one of our priorities. With CSIO’s eDocs capability, documents are delivered to broker management systems (BMS) directly from an insurer’s system via CSIOnet.

The Standardization of eDocs was a top priority in CSIO’s new strategic plan. We had discovered that eDocs were inconsistently labelled within BMSs, and that those labels sometimes did not reflect the contents of the document correctly. It meant that brokers had to open eDocs to determine if they required action and relabelling.

In 2023, we refined the eDocs codes and descriptions via a four-step collaborative process:

1

Conducted discovery sessions with brokers, insurers and BMS vendors to identify and update unclear eDocs codes and descriptions. We also identified 18 codes that are no longer required.

2

Surveyed hundreds of brokers across Canada to collect feedback on CSIO’s proposed eDocs codes and descriptions.

3

Hosted focus group sessions with the brokers across the country to ensure all use cases had been captured accurately, and that our proposed labelling was clear. Each session was dedicated to a specific BMS.

4

Formed an eDocs Working Group – including brokers, insurers and BMS vendors – which came together to achieve a consensus on a list of refined eDocs codes and descriptions. The use cases covered billing, claims, policy transaction, cancellations, lapses and underwriting. CSIO then completed the eDocs Business Requirements and Certification document (BRCD) for insurers and vendors to review, and plan for implementation. Brokers will benefit from this effort once their insurer and BMS vendor has programmed these Standards into their systems.

Thanks to the collaboration of all involved, CSIO met its 2023 objective on this important industry initiative. Clearly labelled eDocs will save brokers valuable time and money.

The Fantastic 40

These eDocs descriptions capture all industry use cases.

Use Case Outlines |

Number of eDocs Descriptions |

|---|---|

|

Billing |

15 |

|

Claims |

7 |

|

Policy Transaction (Policy dec & liability certificate) |

12 |

|

Cancellation |

5 |

|

Underwriting Request |

1 |

Broker resources developed are on the Updated eDocs Rescource page.

After the requirements to program the updated eDocs codes and descriptions were delivered to insurer and vendor members, they were asked to provide their implementation timelines, which we published on the eDocs Programming Scorecard.

CSIO also established an eDocs Implementation Steering Committee that includes insurer, vendor and broker representatives. The Committee will help develop a robust end-to-end user-acceptance testing (UAT) plan, and support communication between brokers and the industry.

We thank the members of our eDocs Working Group and eDocs Implementation Steering Committee for their dedication to this important initiative.

Top 10 Benefits of eDocs

Standardized naming convention for documents received by insurers

Support all lines of business – personal, commercial and farm

Compatible with any software, document and file-type

Ensure seamless transfers and easy downloads

Established as the industry’s most widely used document delivery technology

Designed for CSIOnet, the industry’s leading platform

Brokers can send eDocs to customers from their BMS

No need to go to insurer portals for documents

Brokers can view documents sent by the insurer to the insured customer

Real-time and batch

Aly Kanji

President & Chief Executive Officer at InsureLine Brokers Inc.

CSIO’s structured approach was instrumental in reaching a consensus and advancing the standardization of eDocs descriptions in a short period of time.

The industry coming together and CSIO’s structured approach was instrumental in reaching a consensus and advancing the standardization of eDocs descriptions in a short period of time. The output from the eDocs Working Group will ensure a standardized industry approach, which will provide further opportunity for automation within the broker’s workflow while providing brokers with an enhanced experience.

Standards Governance Advisory Council

CSIO established its Standards Governance Advisory Council in July 2023. The Council’s mandate is to drive collaboration among CSIO member organizations on the implementation of unambiguous Standards.

CSIO’s strategic plan includes a commitment to further improve Standards and corresponding implementation guides to ensure there is complete alignment on stakeholders’ interpretations of the Standards. That requires the implementation of a detailed Standards adoption framework that includes a Standards Certification Rating.

The Standards Governance Advisory Council oversees these Certification Ratings to ensure that the Standards are aligned with current and future needs.

At the end of 2023, Council members reviewed recommendations for a Standards Certification Rating and made its selection. CSIO will have its insurer members complete a scorecard which will guide the Certification Rating publication in early 2024.

Commercial Lines Data Standards

The Commercial Lines (CL) Working Group continued to advance CL Data Standards in 2023. It published business requirements to quote and bind three additional CL industry segments: hospitality, health services and warehousing.

That brings the number of industry segments with published CL Data Standards to seven. The full list also includes professional services, contractors, real estate and retail industries. Additional segments will follow in the years ahead.

These Standards support real-time accurate small business commercial quotes in minutes. They save brokers time and money and improve customer experience.

Brokers using the Standards with the CL Minimum Data Set (MDS) report that their average quote response time – from insurers – has decreased from days to an average of just 14 seconds.

When insurers and vendors use CL Data Standards to program the required requirements for quoting and binding CL risks, they allow brokers to exchange data in a simple, structured format. The data flows from their BMS to the insurer’s system via an Application Programming Interface (API).

Brokers can be confident that their data remains confidential when they utilize CL MDS via the API workflow. Data is transferred securely for each single transaction and is never shared outside of that exchange.

Top Five Benefits of CL Data Standards

Automated quotes in real time

Faster information flow between broker and insurer systems

More accurate quotes

Savings by the digitalization of transactions

Automatic generation of electronic policy documents by a BMS

We are grateful to the members of our Commercial Lines Working Group. Their time and expertise make a positive impact on our industry every day.

Commercial Lines Certification Program

CSIO supports members in their journey to demonstrate their commitment to CL Data Standards with structured and consistent data and workflows. The CL Certification program is CSIO’s guarantee that an insurer or vendor is fully compliant with industry best practices .

L’Unique General Insurance achieved Level 3 Certification in 2023.

National Standards Working Group

In addition to these achievements, members on our National Standards Working Group collaborated to keep Standards up to date. Thanks to the Working Group, EDI and XML Data Standards are reviewed and updated monthly, based on member’s requests, to keep them in sync with business needs. Since product evolution doesn’t stop, neither does the evolution of these Standards.

Delivering Secure and

Reliable Solutions

CSIO’s ability to deliver technology solutions that are credible, secure and reliable depends heavily on keeping up to date with developments in the Property and Casualty (P&C) insurance industry and the security landscape. We consult regularly with data and cybersecurity experts to ensure we remain at the forefront of cybersecurity best practices, emerging industry trends and regulations.

CSIO is committed to maintaining robust Data Standards and employing security best practices in enhancements for our CSIOnet and My Proof of Insurance (MPOI) solutions. We are equally dedicated to promoting the adoption of CSIO’s Application Programming Interface (API) Security Standards and evolving API Security Standards for microservices.

CSIO achieved these accomplishments on this front in 2023.

API Security Standards

CSIO’s API Security Standards are an agreed-upon set of requirements that enable a broker management system (BMS) to connect to multiple insurer systems seamlessly.

Our Innovation and Emerging Technology (INNOTECH) Advisory Committee and its API Security Working Group – published the industry’s first API Security Standards in 2022, providing insurers and BMS vendors with a standard authentication and authorization API model. By implementing these Standards, insurers and BMS vendors ensure that security best practices are in place for API integration between partners.

CSIO’s API Security Working Group, comprised of industry security experts, developed forward-thinking API Security Standards in line with best-in-class solutions. Security guidelines and recommendations incorporated eight key areas:

- data confidentiality

- API endpoint security

- security logging and monitoring

- security testing

- identity

- authentication

- authorization access control

These Standards are based on industry best practices for API Security (e.g., OWASP API Top 10). They align with CSIO and the API Security Working Group’s requirements with respect to future plans and the Standards’ applicability to security elements such as protocol types, identity and an authentication framework for APIs. The Standards also address security concerns related to specific protocols, including OAuth 2.1.

Our work is not done. CSIO will evolve the API Security Standards to accommodate more use cases, API interactions and microservices.

Top Three Benefits of API Security Standards

Seamless log-in process for brokers

Versatility – allows for new functionality

Incorporates industry best practices

API Security Standards Certification Program

CSIO launched its API Security Standards Certification program in 2023. The program provides member organizations an opportunity to confirm alignment with the API Security Standards and demonstrate that they have mitigated all security concerns, including API endpoint security.

The Certification is awarded to members who show their commitment to being an effective, efficient API partner by implementing the CSIO API Security Standards. Brokers can be certain that by accessing an API endpoint – such as obtaining a quote – their data and credentials are safe with the member.

Congratulations to Northbridge Insurance

In 2023, Northbridge Insurance became the first insurer to attain API Security Standards Certification.

This identifies Northbridge Insurance as a security-focused company that is committed to protecting client information. By implementing CSIO’s API Security Standards, Northbridge provides peace of mind to its broker partners that they’re dedicated to maintaining robust security measures.

First insurer certified

Silvy Wright

Chief Executive Officer, Northbridge Insurance

Obtaining the API Security Standards Certification is one way that Northbridge remains steadfast in supporting our broker partners.

Northbridge Insurance is committed to innovating and using best practices for safeguarding client information. Obtaining the API Security Standards Certification is one way that Northbridge remains steadfast in supporting our broker partners with security protocols.

CSIOnet

CSIOnet is an established, widely adopted platform on which data and documents are exchanged between insurers and brokers in the Canadian P&C Insurance industry. The platform delivers eDocs and messages to brokers using Electronic Data Interchange (EDI) and Extensible Markup Language (XML).

We modernized CSIOnet in 2022 by moving it from a legacy physical server platform to a robust, state-of-the-art Amazon Web Services (AWS) cloud-based environment. This equipped CSIOnet with enhanced reliability for optimal performance, improved download speeds and upgraded security measures to better protect information shared across the system. AWS also provided us with improved problem detection and resolution capabilities.

Upgrading CSIOnet met the evolving expectations of policyholders, along with the security and stability requirements of the companies that serve them, and enabled CSIO to reach a 99.84% availability rate (excluding scheduled maintenance).

CSIOnet Accomplishments

- Achieved more than a 10% increase in the volume of EDI and XML messages sent via CSIOnet, compared to the 2022 period preceding our AWS migration

- Over 48 million eDocs sent in 2023 – a record number

- Used daily by 38,000+ brokers and 85+ insurers

Top Five Benefits of CSIOnet’s AWS Cloud Platform

Fast electronic data interchange and eDoc transfers

Enhanced security to reduce cybersecurity and other risks

Improved problem detection and resolution

Scalable capacity to support continued innovation

Streamlined innovation capabilities to meet evolving customer demands

Martin-Alexandre Beaulieu

Senior Developer Analyst at Intact Insurance

Our policy downloads via CSIOnet on the new AWS platform went super smooth. Blazingly fast!

Our policy downloads via CSIOnet on the new AWS platform went super smooth. We started processing at about 11 a.m. for our extremely large volume of eDocs that were pending, and by 12:57 p.m., they were ALL out the door. Blazingly fast! Normally, this causes us to push the clock on the next overnight run.

My Proof of Insurance (MPOI)

MPOI is Canada’s leading solution for securely emailing customers digital documents, including proof of auto insurance (eSlips). Customers can receive and view documents on any device, and eSlips can be stored in a smartphone’s mobile wallet.

Given the accelerated digitization of Canada’s P&C Insurance industry that we’ve seen in recent years, it’s clear that CSIO leadership demonstrated foresight in implementing the seamless, secure MPOI delivery platform.

Since its 2018 launch, members have sent more than 2.5 million digital documents, including eSlips, via MPOI. We have continuously enhanced the platform’s functionality and security over that period.

Top Six Benefits of My Proof of Insurance

Fast and seamless

Bank-grade security

Compliant with industry regulations

Plug-and-play implementation, with minimal training required

Sends policy documents, billing statements and eSlips

Works on any device, with no need for apps or passwords

Tatjana Lalkovic

Senior Vice President and Chief Technology Officer at Definity Financial and CSIO Board Member

This advancement reflects our commitment to drive innovation in the broker channel.

CSIO’s My Proof of Insurance helps us provide customers a convenient option to access their insurance documents digitally. This advancement reflects our commitment to drive innovation in the broker channel and to help our broker partners empower their customers with reliable and innovative service.

Shaping Solutions and Services

CSIO’s solutions and services are designed to create a seamless experience for our members and their customers, and provide industry-leading education for our members. We do this – in collaboration with our members – considering current and future needs.

In 2023, we made significant progress in shaping CSIO’s solutions and services.

More Progress on the INNOTECH API Data Standards

CSIO’s INNOTECH Advisory Committee and its API Implementation Working Groups made great strides in 2023 by advancing broker technology and delivering innovative API Data Standards.

APIs enable broker management systems (BMSs) and insurer systems to share information with one another quickly and easily. Without APIs, brokers would have to log into the insurance company’s portal or contact the company by email or telephone to complete customer transactions.

Thanks to CSIO’s API Data Standards, insurer systems programmed with API coding can share information back and forth with BMSs securely, in real-time, faster than ever before. JSON – the state-of-the-art technology for API data interchanges – allows condensed sets of data to move rapidly between systems. It is the best available technology for API data interchange to deliver critical information between insurer and broker systems instantly.

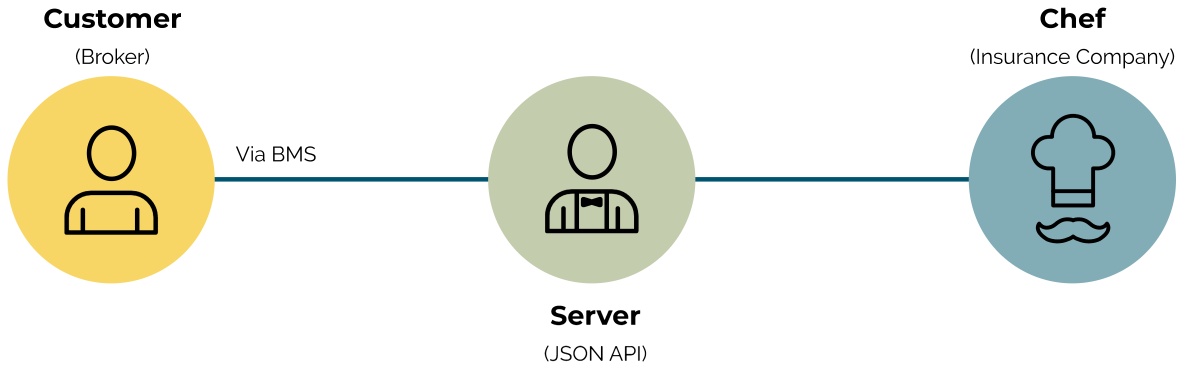

Think of the broker as a restaurant’s customer. The insurance company – the chef in this metaphor – prepares whatever meal the broker asks for. The order is submitted via BMS and relayed to the kitchen by JSON API Standards. That makes JSON the restaurant server. JSON ensures that the broker’s request is communicated quickly, clearly and efficiently. Far more so than if the broker were to go into the kitchen and try to get the chef’s attention directly.

Delivering on our 2023 API Development Roadmap

Thanks to the dedication of our API Implementation Working Groups, CSIO achieved these significant accomplishments in 2023.

1. Completed the business requirements for an additional 165 use cases for personal lines auto, personal lines habitational, Individually Rated Commercial Automobile (IRCA), and Commercial General Liability (CGL). Key use cases include:

- policy cancellation

- creation of first notice of loss (FNOL)

- addition or deletion of coverage on risk

- addition of vehicle or driver

- get claims status

- amend payment details

- amend address of a financial institution

2. Published the JSON API Implementation Guide to help insurers and vendors program the JSON API Standards into their systems.

The JSON API Implementation Guide was developed as a result of industry collaboration. CSIO consulted with Working Group members who have API implementation experience, which included insurers and vendors. In doing so, we were able to gather feedback on what kind of implementation support was required. Specifically, Working Group members discussed ways to improve the messaging workflow and ensure that data is synchronized between vendor and insurer applications.

With the Guide now published, along with the API Security Standards and JSON API Standards for technical schemas, CSIO and its API Working Groups have provided insurers and vendors with the primary tools and APIs necessary for the majority of a brokers’ daily business activities.

In 2024, the API Implementation Working Groups will continue their development of use cases. They also plan to implement a JSON API Standards Certification program.

Top Five Benefits of API Data Standards

Real-time data exchange between insurer systems and BMSs

Fluid information delivery

Eliminates multiple portals and processes

Improves customer experience

Saves time

High-Quality Professional Development

CSIO provides a catalogue of free, online accredited courses, and webinars so that members can keep pace with industry best practices and evolving trends.

At the end of 2022, we launched a bi-annual member survey to shape how we would continue to evolve our educational program and Professional Development platform, which led to CSIO making these enhancements:

- Introduced a fourth stream covering Industry Trends & Initiatives. That’s in addition to our existing three streams: Digital Marketing, Cybersecurity, and Technology Innovation.

- Launched the Building a Culture of Ethics in Insurance webinar and course – the first webinar attracted a record 746 attendees.

- Added new courses and webinars on technology trends such as Generative AI and Marketing Automation, along with additional cybersecurity courses to help brokers understand and manage cyber risk.

We also launched a Resource Centre to equip our members with additional online training to learn more about important industry topics and initiatives. CSIO is committed to helping members improve their knowledge of digital transformation best practices, digital tools and technologies that drive enhanced customer experiences.

In 2023, CSIO partnered with three colleges that offer respected property and casualty insurance programs to support their students’ career development:

- Humber College

- Seneca Polytechnic

- Centennial College

The CSIO Digital Member Designation

Again, this year, we helped CSIO members stand out as lifelong learners. Those who complete our six courses earn CSIO’s Digital Member Designation and are acknowledged on our website. We provide them with an industry-recognized certificate and a congratulatory logo that they can use to highlight their success.

Top Five Benefits of Professional Development

Free, accredited courses on demand

Industry-recognized Digital Member Designation

Top professional instructors

Increase brokers’ digital competencies

Promotes digital best practices